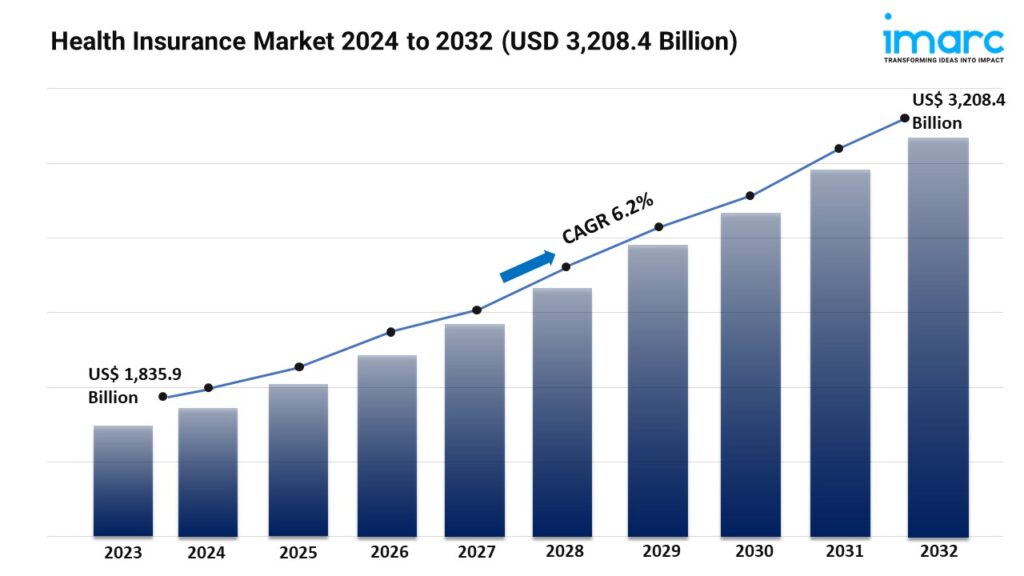

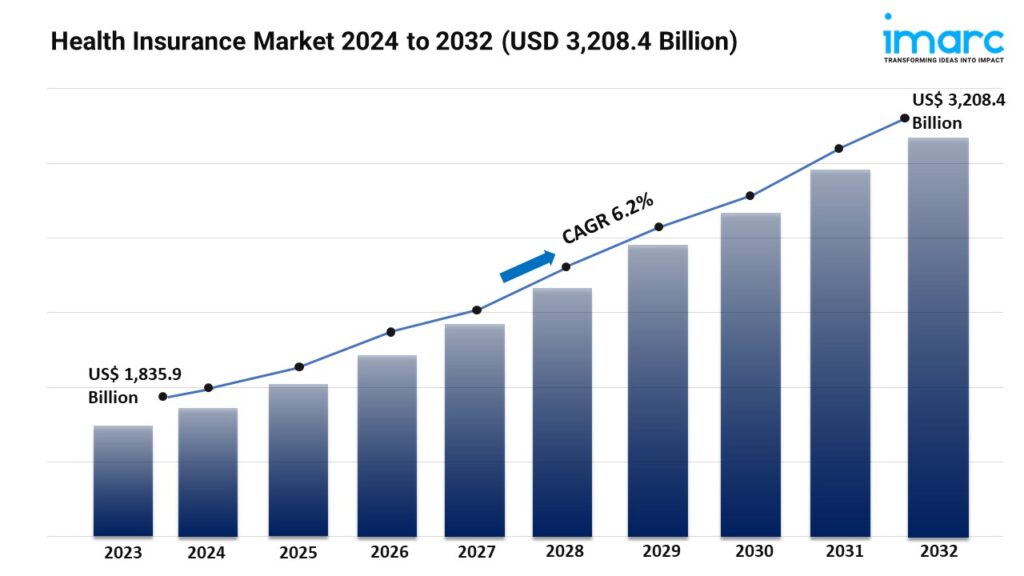

IMARC Group's report titled "Health Insurance Market Report by Provider (Private Providers, Public Providers), Type (Life-Time Coverage, Term Insurance), Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others) Demographics (Minor, Adults, Senior Citizen), Provider Type (Preferred Provider Organizations (PPOS), Point of Service (POS), Health Maintenance Organizations (HMOS), Exclusive Provider Organizations (EPOS)), and Region 2024-2032", The global health insurance market size reached US$ 1,835.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 3,208.4 Billion by 2032, exhibiting a growth rate (CAGR) of 6.2% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/health-insurance-market/requestsample

Factors Affecting the Growth of the Health Insurance Industry:

The increasing awareness about the importance of preventive care in maintaining overall health and well-being is propelling the market growth. Health insurance plans often cover preventive services at little to no cost to the insured, incentivizing enrollment and utilization of these services. Moreover, awareness campaigns and educational initiatives are promoting early detection and management of chronic conditions, such as diabetes, hypertension, and cancer. Health insurance facilitates access to diagnostic tests, medications, and specialist consultations, enabling individuals to address health concerns promptly and effectively.

The adoption of digital technologies is revolutionizing healthcare delivery, enabling remote consultations, telemedicine services, and virtual care options. Health insurance companies are incorporating telemedicine benefits into their plans, providing members with convenient access to healthcare professionals while reducing costs associated with in-person visits. Furthermore, advanced data analytics tools allow health insurers to analyze large volumes of healthcare data to identify trends, patterns, and risk factors. By leveraging predictive modeling algorithms, insurers can anticipate healthcare needs, identify high-risk individuals, and tailor interventions to improve health outcomes and reduce costs.

As healthcare costs are rising, individuals and families are facing greater financial risks associated with medical expenses. Health insurance provides financial protection by covering a portion of these costs, including hospitalization, surgeries, prescription drugs, and specialized treatments. The prospect of financial security in the face of unexpected healthcare expenses motivates individuals to enroll in health insurance plans, thereby supporting the market growth. In addition, many employers offer health insurance benefits as part of their compensation packages to attract and retain talent. Rising healthcare costs compel employers to provide comprehensive health insurance coverage to employees and their dependents, driving the demand for employer-sponsored health insurance plans and expanding the insured population.

Leading Companies Operating in the Global Health Insurance Industry: