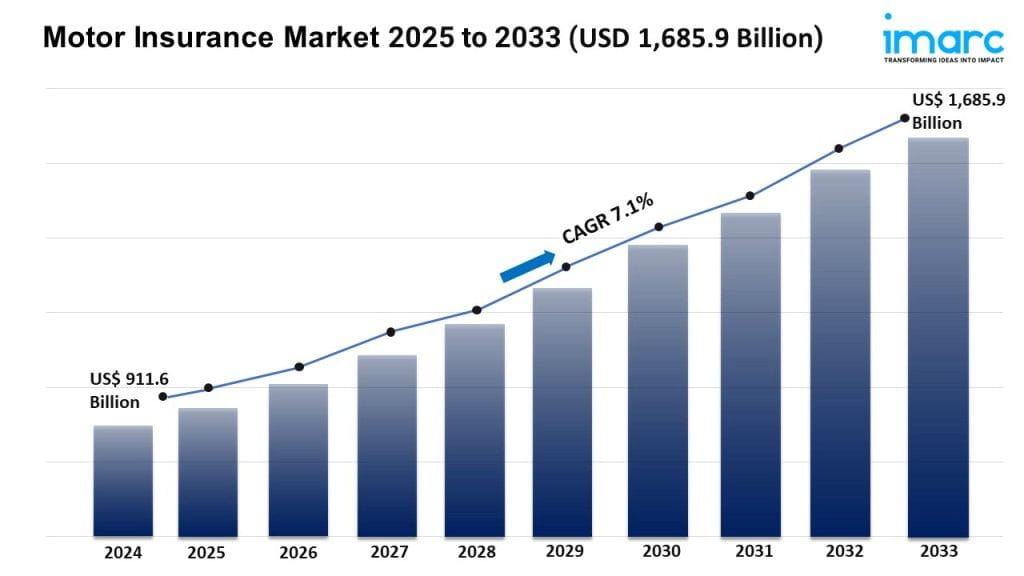

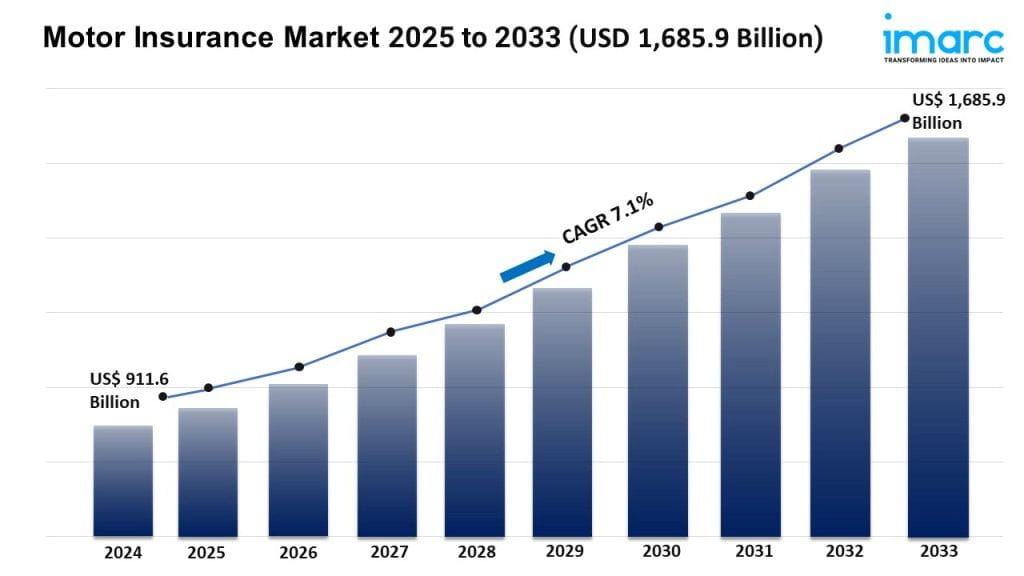

Global Motor Insurance Industry: Key Statistics and Insights in 2025-2033

Summary:

Industry Trends and Drivers:

The global rise in the number of vehicles is impelling the growth of the market. As economic conditions improve and purchasing power increases, more individuals and businesses are able to afford vehicles. This rise in vehicle ownership leads to a corresponding increase in the demand for motor insurance policies, as insurance coverage is typically mandatory for vehicle registration and operation in many regions. Additionally, the diversification of vehicle types, including electric and hybrid models, is propelling the market growth. The growing vehicle fleet also leads to higher incidences of accidents and vehicle-related damages, thereby reinforcing the necessity for comprehensive insurance solutions to mitigate financial risks for vehicle owners.

The integration of telematics allows insurers to collect real-time data on driving behaviors, which can be used to tailor insurance premiums more accurately and reward safer driving practices. Moreover, innovations, such as autonomous driving technology and advanced driver-assistance systems (ADAS), are influencing underwriting processes and risk assessments. These technologies can reduce the frequency and severity of accidents, thereby impacting claims and pricing models. Furthermore, digital platforms and artificial intelligence (AI) are enhancing customer service through streamlined claims processing, personalized policy recommendations, and improved fraud detection mechanisms.

Governments and regulatory bodies frequently update policies and regulations to enhance consumer protection, promote market stability, and address emerging risks. Moreover, stricter enforcement of mandatory insurance laws ensures higher penetration rates of motor insurance. Additionally, regulations surrounding minimum coverage requirements, premium calculations, and claims processing standards can influence the competitiveness and transparency of the market. Environmental regulations promoting electric and hybrid vehicles also affect the types of insurance products offered. Regulatory frameworks may also incorporate measures to combat insurance fraud, enhance data privacy, and ensure fair practices in the industry. As these regulations evolve, motor insurance providers must stay compliant while innovating to meet new legal standards and customer expectations.

Grab a sample PDF of this report: https://www.imarcgroup.com/motor-insurance-market/requestsample

Motor Insurance Market Report Segmentation: